- Published on

SCHD: An ETF Pursuing Stable Dividends and Growth Simultaneously

Key Features of SCHD

- Fund Manager: Schwab ETFs

- Inception Date: October 20, 2011

- Total Assets: Approximately $498.1 billion

- Average Trading Volume: $3,185,406

- Expense Ratio: 0.06% (very low)

Investment Strategy

SCHD tracks the Dow Jones U.S. Dividend 100 Index. This index selects stocks based on the following criteria:

- Minimum 10-year consecutive dividend payment history

- Minimum market capitalization of $500 million

- Minimum daily average trading volume of $500,000

- Considers dividend growth rate, cash flow to dividend ratio, and yield

Through these strict selection criteria, SCHD invests in financially stable companies with expectations of consistent dividend growth.

Advantages of SCHD

- Stable Dividends: Provides an average dividend yield of over 3%

- Dividend Growth: Composed of companies showing consistent dividend increases

- Low Cost: Very low expense ratio of 0.06%

- Diversification: Diversified investment in about 100 quality dividend stocks

- Tax Efficiency: Potential for compound effects through dividend reinvestment

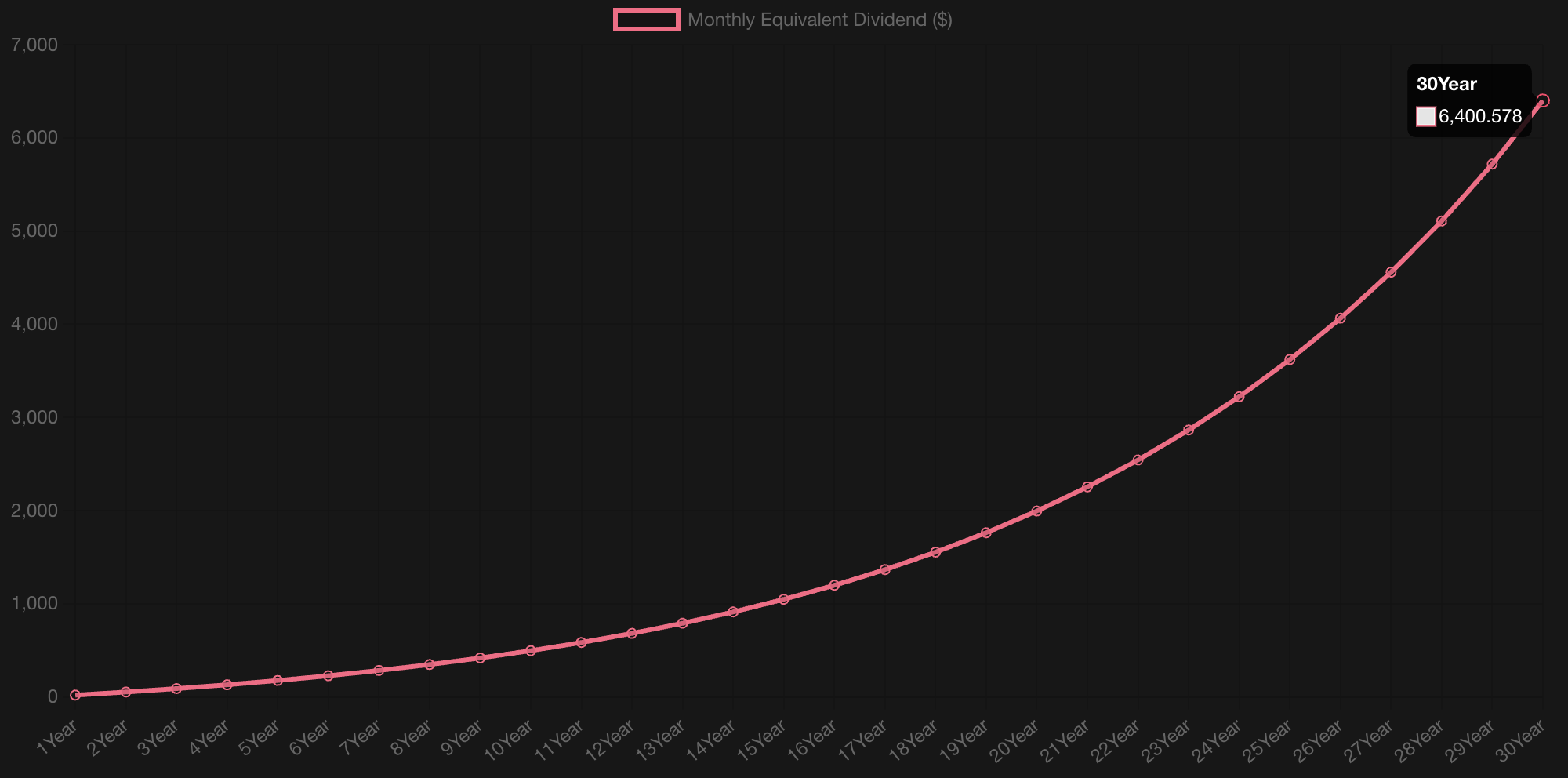

SCHD Long-term Investment Simulation: Monthly Dividend Income After 30 Years

Calculation Assumptions

- Monthly Investment: $1,000

- Investment Period: 30 years (360 months)

- Annual Dividend Yield: 3.5% (SCHD's recent average dividend yield)

- Annual Stock Price Growth Rate: 10% (conservative estimate)

- Annual Dividend Growth Rate: 9%

- Full dividend reinvestment

Expected Results After 30 Years

Under these assumptions, after 30 years of consistent investment:

- Total Investment Principal: $360,000

- Estimated Portfolio Value: Approximately $2.25 million

- Annual Dividend Income: About $79,000

- Monthly Dividend Income: About $6,580

Result Analysis

After 30 years of consistent investment and dividend reinvestment, it's expected that you could earn a substantial amount in monthly dividend income. This amount surpasses many people's monthly salaries and could provide a stable cash flow after retirement.

It's noteworthy that the final portfolio value has significantly increased compared to the initial investment principal of $360,000. This demonstrates the power of compound interest and consistent dividend reinvestment.

[The rest of the content remains the same]