- Published on

TSLY: Hidden Risks and Investment Strategies of a High-Yield ETF

Structure and Operating Mechanism of TSLY

Building a Synthetic Long Position

Unlike traditional covered call ETFs, TSLY does not actually hold Tesla stock. Instead, it creates a synthetic long position using options:

- Buying Tesla call options

- Simultaneously selling Tesla put options

- These options typically have 6-month to 1-year expiries, with strike prices close to the current Tesla stock price

This strategy allows TSLY to replicate about 100% of Tesla's stock price movements.

Selling Short-Term Call Options

On top of the synthetic long position, TSLY sells call options with the following characteristics:

- Expiry: Officially less than a month, but in practice, they prefer very short-term options of just a few days.

- Strike Price: Set 5-15% higher than the current Tesla stock price.

- Rollover Strategy: Frequently repeats the process of selling new options as they expire.

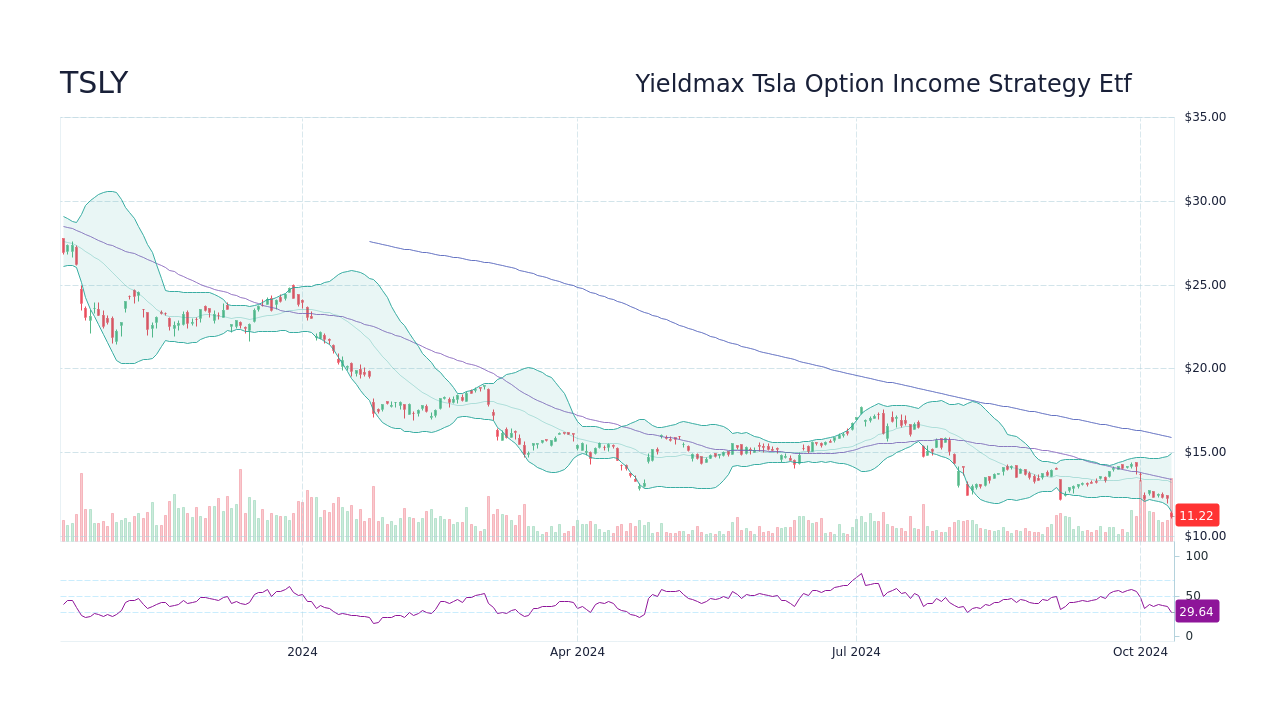

Correlation with Tesla Stock Price

TSLY's performance is closely related to Tesla's stock price fluctuations:

- When stock price rises: Upside gains are limited due to option selling

- When stock price falls: Option premiums offset some losses, but protection is limited in case of significant drops

- During high volatility: Potential for increased short-term gains due to higher option premiums

Advantages of TSLY

- High Distribution Rate: TSLY currently boasts an impressive distribution rate of 87.99%.

- Professional Management: Complex option strategies are managed by experts.

- Accessibility: Available in ETF form, making it easily accessible to retail investors.

Hidden Risks of TSLY

- Risk of Principal Loss: A significant portion of the high distribution rate may be a return of investors' principal.

- Limited Upside: Due to the covered call strategy, gains are capped if Tesla's stock price rises significantly.

- Volatility Risk: High volatility in Tesla's stock price can lead to substantial losses.

- Declining Distributions: The distribution amount is likely to decrease over time.

Investment Strategies and Considerations

- Portfolio Allocation: TSLY should be considered as only a small portion of the overall portfolio due to its high-risk nature.

- Market Awareness: It's crucial to monitor Tesla's stock price direction and volatility.

- Tax Considerations: Be aware of the tax implications of high distributions.

- Avoid Long-Term Holding: TSLY may be more suitable for short-term tactical allocation.

Analysis of Fund Inflows and Outflows

Monthly Fund Flows

Analysis of TSLY's monthly fund flow data revealed the following interesting patterns:

- Rapid Initial Inflow: TSLY saw an inflow of about $800 million in its first three months after launch, reflecting high investor interest.

- Volatility-Driven Flows: Fund inflows tended to increase during periods of high Tesla stock volatility, suggesting investors are targeting high option premiums.

- Correlation with Distribution Timing: Small inflows were observed just before monthly distribution payments, indicating short-term profit-seeking behavior.

- Movements Around Tesla Earnings: TSLY's fund flows showed significant fluctuations around Tesla's earnings announcements, with inflows before and outflows after the reports.

Interpretation of Investor Psychology

These fund flow patterns reflect the following investor sentiments towards TSLY:

- Expectations of high returns

- Speculative tendencies aiming for short-term market timing

- Strategic approach to capitalize on Tesla stock volatility

Investor Type Analysis

Institutional vs. Retail Investors

Analysis of TSLY's investor composition revealed the following characteristics:

- Institutional Investor Share: Institutional investors hold about 41% of total TSLY holdings, which is lower than typical ETFs.

- Retail Investor Preference: TSLY is highly popular among retail investors, who account for about 59% of total holdings.

- Cautious Approach by Institutions: Institutional investors' TSLY holdings have been gradually increasing over time, suggesting a shift from initial caution to more positive evaluation.

- Hedge Fund Interest: Some hedge funds have started using TSLY as a portfolio diversification tool, indicating market recognition of TSLY's unique return structure.

Investor Behavior Patterns

- Retail Investors: Show a strong tendency for short-term profits, with trading patterns aligned with distribution payment timing.

- Institutional Investors: Evaluate TSLY from a long-term perspective, typically using it as a small portion of their portfolio.

- Hedge Funds: Use TSLY as a strategic tool to capitalize on Tesla stock volatility.

Conclusion

While TSLY pursues high returns through a unique investment strategy, it also carries significant risks. Investors should carefully consider their investment goals and risk tolerance when approaching TSLY. It may be wise to use TSLY as a small portion of the overall portfolio and as a short-term strategic tool.