- Published on

Bond Investment Strategies During Interest Rate Cuts: A Smart Way to Maximize Returns

Bond Investment Strategies During Interest Rate Cuts: A Smart Way to Maximize Returns

As interest rate cuts approach, many investors are turning their attention to bond investments. Let's seize the opportunity with a smart investment strategy to maximize bond returns.

Why Bond Investments Are Gaining Attention

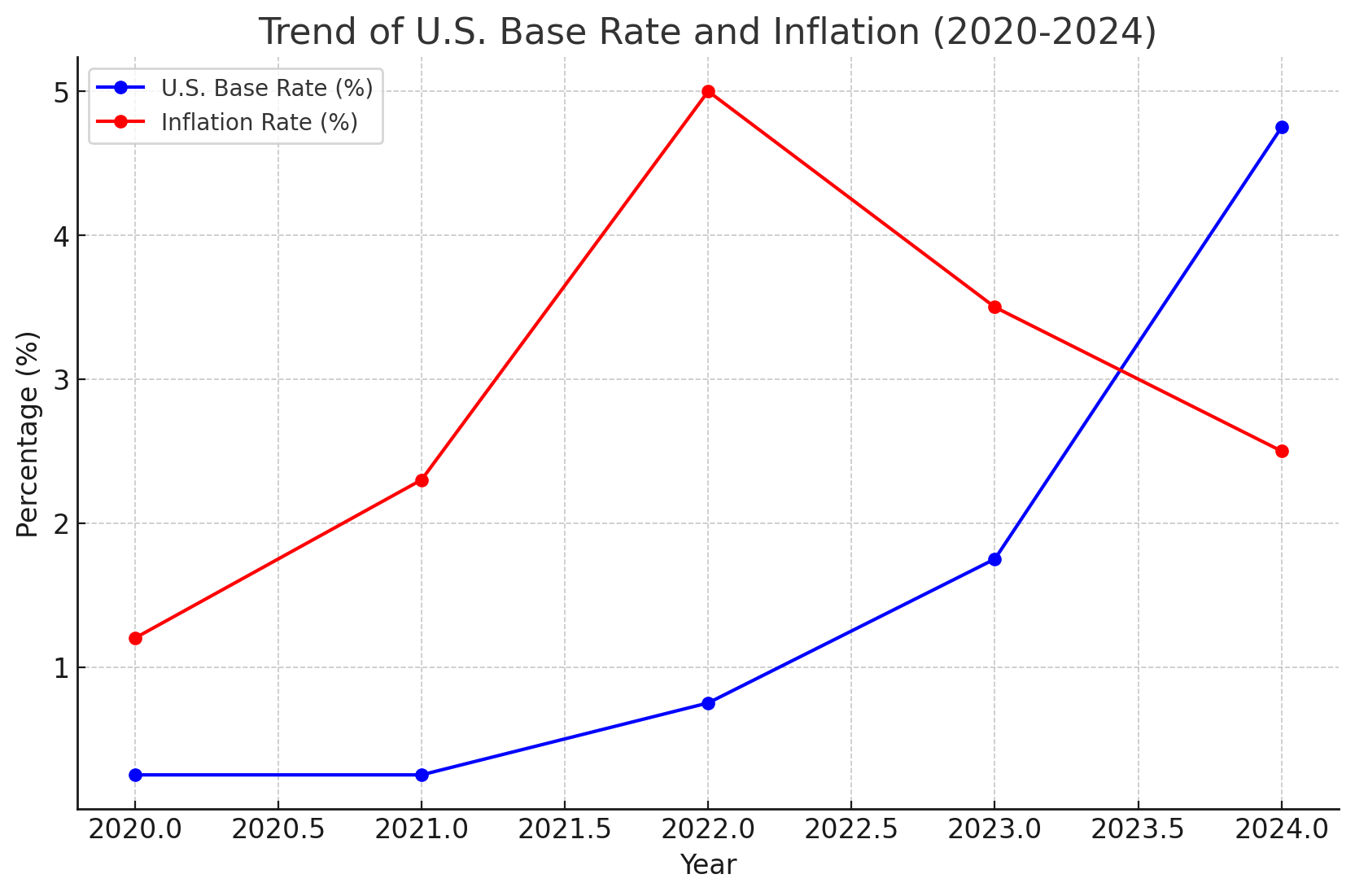

The global financial market is on the verge of transitioning into an interest rate cut cycle. The Federal Reserve (Fed) made a significant rate cut in September 2024:

| Reason | Description |

|---|---|

| Expectation of Rate Cuts | Increased possibility of bond price appreciation due to rate cuts |

| Stable Returns | Preference for relatively safe bond investments during rate cuts |

- Base Rate Cut: In September 2024, the base rate was cut by 0.5 percentage points, maintaining a range of 4.75-5.0%.

- Price Stability: Inflation has fallen to 2.5%, close to the Fed's target of 2%.

Relationship Between Interest Rates and Bond Prices

Bond prices tend to move inversely with interest rates. For example:

- A bond issued with a 5% rate becomes a more attractive investment when the market rate falls to 2%.

- Investors are willing to pay a premium for existing bonds with higher interest rates.

Background of the Rate Cut

The Fed's decision to cut interest rates was influenced by the following factors:

| Factor | Description |

|---|---|

| Price Stability | The stability of prices continues, easing inflationary pressures. |

| Labor Market Weakness | Concerns about a weakening labor market have grown, with unemployment rising from 3.7% at the beginning of the year to 4.2%. |

Smart Bond Investment Strategies

1. Diversified Investment Approach

In uncertain market conditions, the following diversification strategies are essential:

| Diversification Strategy | Description |

|---|---|

| Allocation Between Government and Corporate Bonds | Government bonds offer stability, while corporate bonds can provide higher returns. |

| Mix of Short- and Long-Term Bonds | Short-term bonds offer liquidity, while long-term bonds can benefit from price increases due to rate cuts. |

| Domestic and International Bond Diversification | Global diversification can help reduce risk and maximize opportunities. |

2. Duration Strategy

During interest rate cuts, long-term bonds can be more advantageous. Bonds with longer maturities have higher price volatility due to interest rate changes. Therefore, increasing the proportion of long-duration bonds during rate cuts can be effective.

3. Stepwise Purchase Strategy

Interest rate cuts can occur in several stages, so it may be prudent to purchase bonds stepwise. This can help maximize the benefits of rate cuts.

Future Interest Rate Outlook

The Federal Reserve has also hinted at further rate cuts:

| Forecast | Description |

|---|---|

| End of 2024 | Indicated the possibility of an additional 0.5 percentage point rate cut |

| 2025 | Forecast to lower the base rate to around 3.5% |

| 2026 | Expected to fall to around 3.0% |

This rate cut cycle is being evaluated as a cautious approach to a soft landing for the U.S. economy and is expected to positively impact the global financial market.

Points to Consider When Investing in Bonds

When investing in bonds, consider the following factors:

| Consideration | Description |

|---|---|

| Creditworthiness of Issuer | Bonds issued by entities with low credit ratings may offer high yields but also come with high risks. |

| Investment Duration | Set an appropriate investment duration that aligns with your investment objectives. |

| Currency Risk Management | When investing in foreign bonds, consider the risk of currency fluctuations. |

Investment Execution Strategies

- Stepwise Purchase Strategy: As rate cuts may occur in stages, split purchases over multiple times.

- Focus on High Credit Rating Bonds: Select bonds with high credit ratings for stability.

- Appropriate Maturity Diversification: Invest in bonds with various maturities to secure liquidity and reduce risk.

Conclusion

Bond investments during interest rate cuts can be a good opportunity for investors seeking stable returns. However, given the need for cautious approaches and systematic strategies, it is important to make wise choices that consider your investment goals and risk tolerance.